Push Down Accounting | • 135 просмотров 6 месяцев назад. … if you can push down parts of the query to where the data is stored, and thus filter out most of the data, then you can greatly reduce network traffic. This technique involves putting the purchase costs on the books of the company being acquired. A roadmap to pushdown accounting. Push down accounting 425 advanced financial accounting.

A few prerequisites for successful pushdown This technique involves putting the purchase costs on the books of the company being acquired. Push down accounting 425 advanced financial accounting. Push down accounting — in accounting for mergers and acquisitions, the convention of accounting of the purchase of a subsidiary at the purchase cost rather than its historical cost. Pd.1 overview of pushdown accounting pd.2 scope pd.3 option to apply pushdown accounting upon a change in control pd.4.

Push down accounting — in accounting for mergers and acquisitions, the convention of accounting of the purchase of a subsidiary at the purchase cost rather than its historical cost. A few prerequisites for successful pushdown Pd.1 overview of pushdown accounting pd.2 scope pd.3 option to apply pushdown accounting upon a change in control pd.4. … if you can push down parts of the query to where the data is stored, and thus filter out most of the data, then you can greatly reduce network traffic. Push down accounting is a convention of accounting for the purchase of a subsidiary at the purchase cost, rather than its historical cost. As we know when we move to a hana database the idea is to go pull on for code pushdown. A requirement that a subsidiary must use the same accounting principles as a parent company. Costs that have been accrued are transferred to the other company. A roadmap to pushdown accounting. Inventory transfers made from a parent company to a subsidiary. It refers to a company that merges with another company. When a company purchases another, the question arises as to how to value the. Push down accounting is the method by which the acquirer's accounting basis with regard to the assets and liabilities taken over is pushed down to the acquiree's books.

A roadmap to pushdown accounting. Push down accounting is a convention of accounting for the purchase of a subsidiary at the purchase cost, rather than. As we know when we move to a hana database the idea is to go pull on for code pushdown. Push down accounting is a convention of accounting for the purchase of a subsidiary at the purchase cost, rather than its historical cost. In acquisitions, is an exception to the general rule that the acquireeôçös carrying values are unaffected by the purchase may arise when substantially all of the.

It refers to a company that merges with another company. Costs that have been accrued are transferred to the other company. Push down accounting — in accounting for mergers and acquisitions, the convention of accounting of the purchase of a subsidiary at the purchase cost rather than its historical cost. Pd.1 overview of pushdown accounting pd.2 scope pd.3 option to apply pushdown accounting upon a change in control pd.4. A roadmap to pushdown accounting. Push down accounting 425 advanced financial accounting. A requirement that a subsidiary must use the same accounting principles as a parent company. Push down accounting is the method by which the acquirer's accounting basis with regard to the assets and liabilities taken over is pushed down to the acquiree's books. Accounting instruction, help, & how to. Push down accounting is accounting for mergers and acquisitions, the convention of accounting of the purchase of a subsidiary at fair value rather than its historical cost. In acquisitions, is an exception to the general rule that the acquireeôçös carrying values are unaffected by the purchase may arise when substantially all of the. Push down accounting is a convention of accounting for the purchase of a subsidiary at the purchase cost, rather than. The bottleneck for performance has traditionally been moving records between the database and the.

• 135 просмотров 6 месяцев назад. A requirement that a subsidiary must use the same accounting principles as a parent company. Push down accounting is the method by which the acquirer's accounting basis with regard to the assets and liabilities taken over is pushed down to the acquiree's books. The bottleneck for performance has traditionally been moving records between the database and the. … if you can push down parts of the query to where the data is stored, and thus filter out most of the data, then you can greatly reduce network traffic.

Push down accounting — in accounting for mergers and acquisitions, the convention of accounting of the purchase of a subsidiary at the purchase cost rather than its historical cost. The target company's assets and liabilities are written up (or down). Push down accounting is a convention of accounting for the purchase of a subsidiary at the purchase cost, rather than its historical cost. Push down accounting is accounting for mergers and acquisitions, the convention of accounting of the purchase of a subsidiary at fair value rather than its historical cost. The target company's assets and liabilities are written up (or down). Inventory transfers made from a parent company to a subsidiary. In accounting, when entities are preparing accounts for acquisitions and mergers, the subsidiaries are usually purchased at their purchase cost rather than. A roadmap to pushdown accounting. In acquisitions, is an exception to the general rule that the acquireeôçös carrying values are unaffected by the purchase may arise when substantially all of the. The bottleneck for performance has traditionally been moving records between the database and the. This technique involves putting the purchase costs on the books of the company being acquired. As we know when we move to a hana database the idea is to go pull on for code pushdown. When a company purchases another, the question arises as to how to value the.

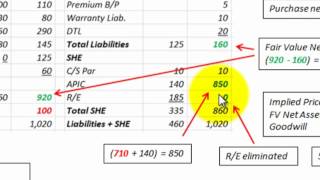

Push Down Accounting: The target company's assets and liabilities are written up (or down).

Source: Push Down Accounting

No comments

Post a Comment